We are delighted to announce the release of our Chargeable Gains Calculator.

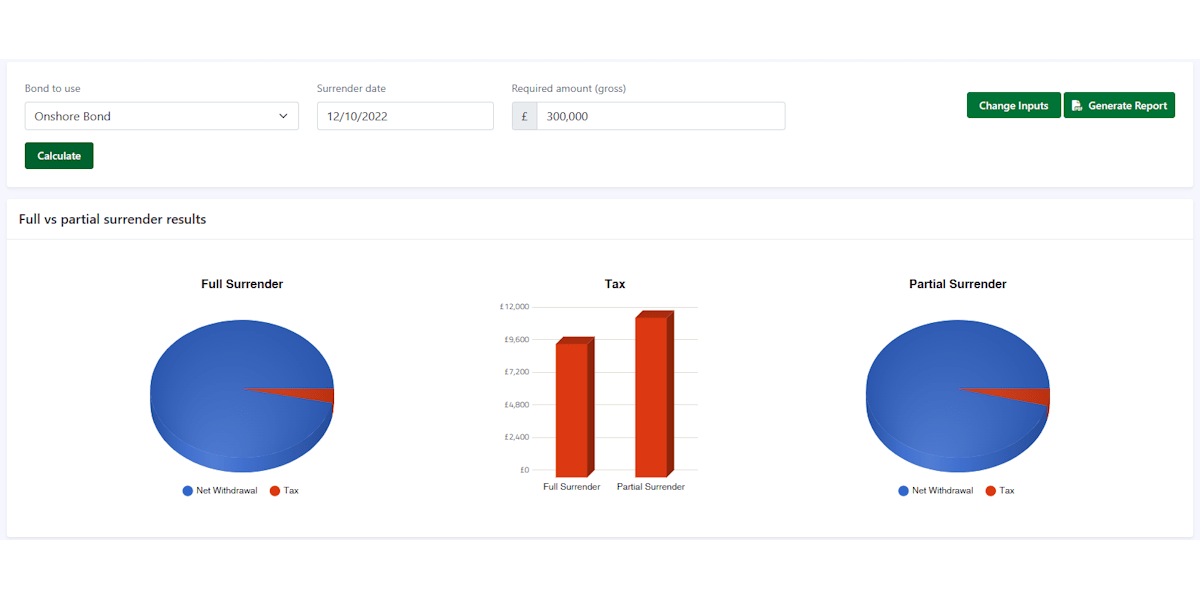

Our new Chargeable Gains Calculator allows you to compare Full and Partial surrenders side by side, including the tax payable on the gain. You can also see the other impacts the surrender could have on future withdrawals and tax on other income.

The calculator also includes:

- Comprehensive Income Tax Calculations – Income Tax calculations for the illustrated gains (including Scottish tax rates), allowing for any other income during the tax year including salary, self-employment, dividends, savings income and include the impact of pension contributions and charitable giving on the tax bands.

- Onshore and Offshore Bonds – The calculator can handle both onshore and offshore bonds and apply the correct tax treatment to these.

- Prefill from Cashflow and your Back Office – There is no requirement to re-enter bonds or income information for your client as these can be pulled into the tool at the click of a button.

- Full Bond History – Build in all past top ups, full surrenders, or withdrawals, including the ability to add multiple events within the same year and recurring withdrawals.

- Multiple Bonds – Bonds held by your clients will be retained, enabling you to pull up the details quickly in the future for considering further withdrawals.

- Top Slicing Relief – Our calculations automatically apply any Top Slicing Relief.

- Jointly Held Bonds – You can include jointly held bonds within our calculator and see the impact of the Full vs Partial comparison across both clients.

- Clear Graphical Outputs – Not only do the results provide the important numbers, but also client friendly charts to illustrate their position.

- Interactive Results – Change the surrender date, required amount, and from which bond on screen to determine the best way to withdraw your clients required amount.

- Comprehensive Report – The client friendly comprehensive report illustrates the full tax breakdown of the Full vs Partial surrender scenario you create.

This release is phase one for the Chargeable Gains Calculator. Coming soon is the ability to show full, detailed and accurate tax calculations for a client who has had multiple chargeable gains from one or more bond within a single tax year.

For further details on the Chargeable Gains Calculator, please contact us.