Our financial planning tools

Cashflow Modeller

Our Cashflow Modeller offers a range of features and benefits to help advisers create comprehensive and visually engaging lifetime cashflow plans for their clients. Here’s how our Cashflow Modeller can bring the client journey to life:

- Visual timeline: You can create a timeline that shows your client’s important life events and goals.

- Goals: Create specific goals and assess the viability of meeting these goals, along with a retirement goal analysis, exploring alternative retirement solutions.

- Tax considerations: The modeller takes tax into account and helps you understand its impact on your client’s finances

- Deterministic outcomes: You can make calculations based on fixed assumptions or a variable set of returns.

- Stress testing: The modeller helps you prepare for different scenarios and see how they could affect your client’s financial situation.

- Your recommendations: You can demonstrate the value of your advice to your clients with our scenario planning comparisons and visually engaging results output.

- Engaging reports: The modeller generates easy-to-understand reports that clearly illustrate your client’s financial journey.

- A powerful cashflow modeller that is easy and intuitive to use.

- Use our prebuilt scenario options including pension or savings transfers, change tax rates, stress testing, death and more which allows you to quickly compare several planning options highlighting the impact of your advice.

- Use our auto withdrawals strategy so that the cashflow will fund any annual shortfall automatically based on your chosen strategy.

- Our client portal allows your clients to complete fact finds that you can review before updating the cashflow data (and even update your back office system).

- Back office integration options to reduce time spent re-keying information and keeping consistent data across systems.

- Monthly calculations allowing for all UK income tax rates.

- Interactive results screen that allows you to easily navigate between scenarios, move timeline events and view multiple charting options.

- Clear graphical output that is underpinned by annual breakdowns including a tax paid analysis.

- Tailor your reports to meet your clients’ specific requirements with customisable reporting options.

Retirement Modeller

- Accumulation phase: You can assess whether your clients are on track to meet their target retirement income level and what could be done about any shortfalls.

- Decumulation phase: You can assess how much market downturn the client can withstand and still meet their retirement income target.

- Tax considerations: The modeller takes into account tax and helps you understand its impact on your client’s retirement income depending on the strategies used.

- Deterministic & Stochastic outcomes: You can make calculations based on fixed assumptions or consider a variable range of possible outcomes.

- Your recommendations: You can demonstrate the value of your advice to your clients with target levels being achieved and visually engaging results.

- Engaging reports: The modeller generates easy-to-understand reports that clearly illustrate these stress testing outcomes.

- Straightforward inputs with intuitive user interface.

- Clear output confirming whether target income is or is not achievable.

- Additional growth required or annual safety margin results to help manage investment risk.

- Auto-withdrawals efficiency to fill shortfalls based on a chosen strategy.

- Capacity for loss analysis to highlight how much loss your clients could withstand at chosen ages.

- Stochastic projections to highlight the range of potential outcomes using asset allocation data.

- Interactive graphical output.

- Client friendly reporting options.

Inheritance Tax Modeller

- Visual timeframe: You can choose the time period to highlight to your clients the impact of IHT on first and second death of either client.

- IHT liability: The modeller helps you understand the IHT position of your clients and provides planning options to reduce any liability they may face.

- Designed planning options: The modeller helps you prepare for different scenarios with specially designed planning options for you to see how they could affect your client’s IHT position.

- Your recommendations: You can demonstrate the value of your advice to your clients with our scenario planning comparisons and visually engaging results output.

- Engaging reports: The modeller generates easy-to-understand reports that clearly illustrate your client’s IHT position.

- Straightforward inputs with intuitive user interface.

- Simple or complex cases can be modelled.

- Sophisticated IHT calculations.

- Illustrate first and second death at any age.

- Simple and complex planning options.

- Maximum tax liability analysis.

- Interactive graphical output that is underpinned by chart breakdowns, including estate on death, estate exempt from IHT, IHT breakdown and estate distribution.

- Client friendly reporting options.

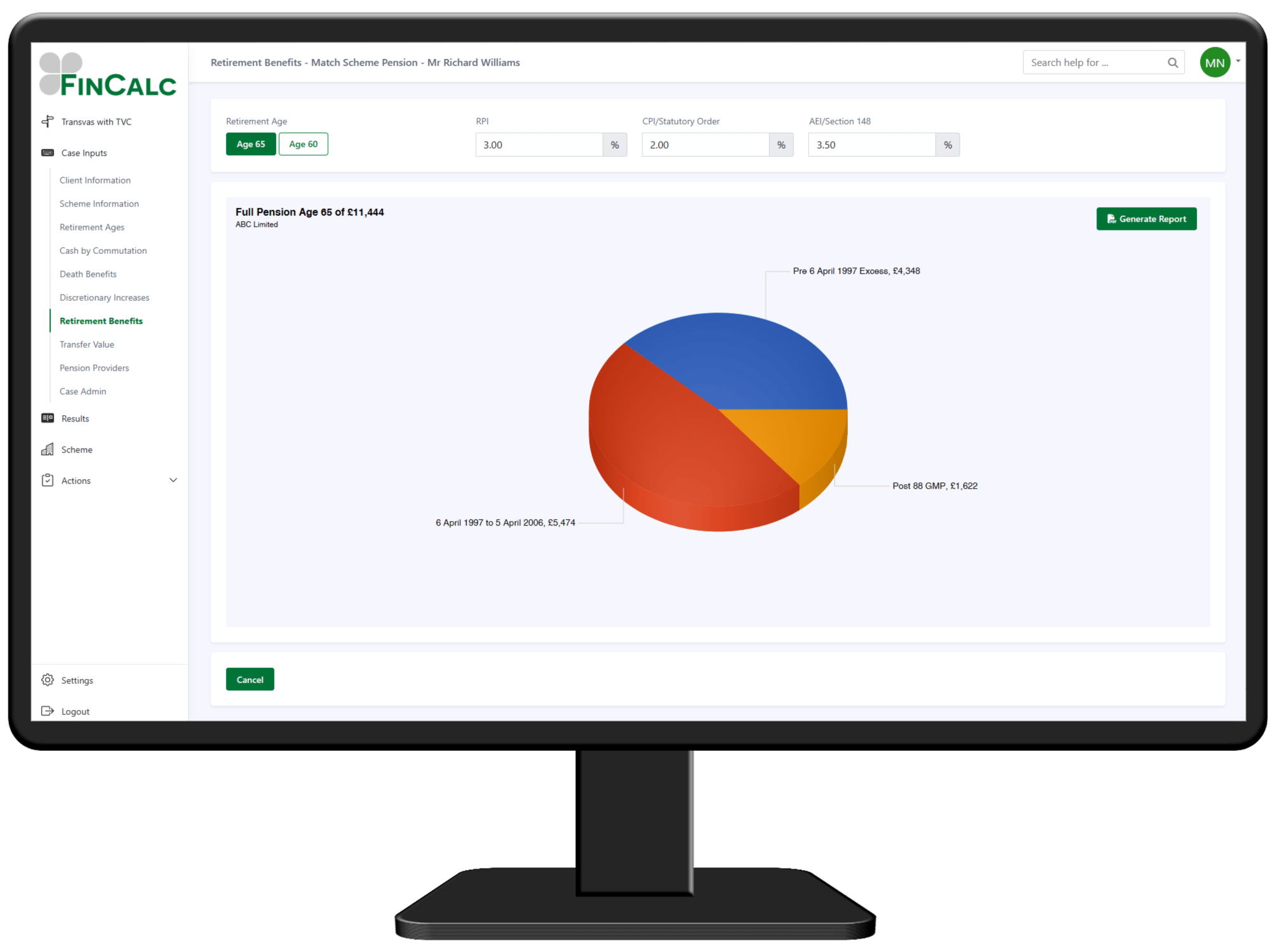

Transvas with TVC

- Full DB Analysis: More than just a TVC report generator, our Transvas with TVC tool is the result of 3 decades of development.

- Compliance: Produce your fully comprehensive COBS compliant pension transfer analysis report with complete peace of mind that it is underpinned by valid, accurate data.

- APTA: Integrates with our cashflow modeller to take your APTA process to another level with a DB Transfer scenario option to compare against keeping the benefits retained in the scheme.

- Your Recommendations: You can demonstrate the value of your advice to your clients with our comprehensive DB analysis output in combination with our scenario planning comparisons and visually engaging results output.

- Engaging Reports: The tool generates easy-to-understand reports that clearly illustrate your client’s existing scheme benefits as well as using the transfer value to highlight any potential benefits of transferring.

- Intuitive user interface.

- Fully COBS compliant.

- Scheme library.

- Handle complex schemes with ease.

- Retrospective reports add on available.

- Data validation.

- Technical support on hand to help.

- Interactive results screen with client friendly graphical output.

- Client friendly reporting options.

Digital Engagement

- Fully branded: Clients will log in to a white labelled client portal that uses your logo and colour scheme to provide clients with comfort and enhances your relationship further.

- Onboarding clients: Whether they are existing, new or even self-onboarding clients, our portal can help you.

- Net worth position: Clients can see their net worth directly on their dashboard with live valuation updates if back-office linked.

- Communication: The portal will allow you to contact your client through secure messaging and even upload documents that need to be actioned. They can also contact you via the portal and provide required documentation.

- Fact finds: You can design your own fact finds and surveys to use within the client portal for your clients to complete and submit. This data can then be readily available for use within FinCalc and even pushed back into one of our back-office providers.

- Data gathering reports: The client portal generates a report containing all the information provided by the clients, providing an excellent annual review document.

- Straightforward inputs with intuitive user interface.

- Onboard your clients with ease.

- Secure messaging.

- Secure document exchange with digital signing options including DocuSign.

- Customise your own digital fact finds for clients to complete.

- Notifications informing you of portal activities.

- Mobile and tablet friendly.

- Can be fully integrated with one of our back-office providers.

CRM Lite

- Activity timeline: You can add all interactions with your clients to their record, including telephone notes, emails, and meeting notes. Stored directly against their FinCalc record for a full audit trail which is easy to review at any time.

- Reminders: You can set reminders not only from any activity but also directly on the client, whether that is to chase a product provider on their behalf or schedule a follow up meeting with your client.

- Notifications: Receive notifications on your FinCalc dashboard for any due or overdue reminders for yourself, your team or for all clients in the company.

- Document storage: You can add documents within the activities to store against the client, as well as creating folders to make finding and retrieving past documents easy.

- Client reviews: You can include the planned next review date against each client. Within the FinCalc dashboard, you can see any reviews overdue or becoming due.

- Straightforward inputs with intuitive user interface.

- Activities added include type, direction of communication, contact options, subject and details.

- Drag and drop feature to include any relevant documents.

- Add reminders on activities to provide a means of follow up actions.

- Options are also available to show audit entries which would include editing activities, adding reminders and marking reminders as complete.

- Notifications are displayed on the dashboard which can be classed as Client Admin Reminders and Client Review Dates. Both will show how many are ‘Overdue’, ‘Due Soon’ or ‘Future’.

Financial Calculators

We offer a versatile suite of calculators, catering to essential financial scenarios. From optimising carry forward assessments to navigating Capital Gains Tax (CGT) and analysing chargeable gains, we provide advisers with the tools for informed decision-making. Here’s how our calculators can assist you with your day to day client needs:

- Precision and Accuracy: comprehensive calculators that are easy to use but have the desired accuracy.

- Efficiency and Time-saving: Streamline complex calculations, saving advisers valuable time.

- Versatility: Cover a wide range of financial scenarios that is an invaluable adviser’s resource.

- Client Confidence: Enhance trust by offering complex advice areas but with a client friendly output.

Clearly compare Full vs Partial surrenders side by side, illustrating comprehensive income tax calculations and transaction breakdowns. You can also see the other important impacts from the surrender including future tax free allowances and increasing income tax on other incomes.

The Portfolio Performance Calculator includes clear and concise graphical analysis of an Investment portfolio which can help you assess investing in different investment holdings within a Portfolio over a specific period of time. This is supported by a professional report (which can be fully branded for the financial adviser firm).

Show the breakdown of the associated costs of investment holdings, taking account of multiple holdings, product charges and adviser charges. You also have the ability to build in Growth to demonstrate the effect of charges against the growth.

Show the weighted average growth of a portfolio of investment holdings. You also have the ability to build in charges to demonstrate the effect of charges against the growth.

Illustrate the annual rate of return of any investment or portfolio across any period, taking into account contributions and withdrawals.

Illustrate the accumulation and/or decumulation of any investment or portfolio across a fixed term using either a stochastic or deterministic forecast.

Easily use this calculator with our system supplied Products (sourced from product providers) to calculate Reduction in Yield and to review illustrations.

You can also build/copy your own Products within our Manage Products section in the Company Settings so they can be used in the calculator.

Use our Carry Forward calculator to illustrate a client’s year on year Annual Allowance position or to have a quick look at the current year’s annual allowance. The calculator allows for Tapering and Money Purchase Annual Allowance, as well as including a DB Pension Input Amount calculator and quick fill contribution calculator.

A quick and easy to use Annual Allowance calculator which provides a review of the current year’s annual allowance or allows you to illustrate a comprehensive year on year Annual Allowance position, including available carry forward. The calculator allows for Tapering and Money Purchase Annual Allowance, as well as including a DB Pension Input Amount calculator and quick fill contribution calculator.

Clearly illustrate the month 1 Emergency Income Tax payable for a pension withdrawal, along with how much to reclaim.

Work out your client’s State Pension Age at the touch of a button. Download a single page report confirming the details, which you can add to your client file for audit purposes

Easily use this calculator with our system supplied Products (sourced from product providers) to calculate Reduction in Yield and to review illustrations.

You can also build/copy your own Products within our Manage Products section in the Company Settings so they can be used in the calculator.

A fully comprehensive Income Tax calculator that accounts for multiple income streams & associated allowances with a summary of Income Tax, N.I. contributions & Student Loan repayments due in detail. You can also compare the current tax year to previous & next year to see how tax changes impact on net income.

Our Capital Gains Tax calculator can take into account multiple owners, unlimited assets and all asset types.

With the ability to include Business Asset Disposal Relief, Investors Relief, Allowable Losses as well as Private Residents Relief and Lettings Relief.

See when your client may clear their student loan and compare whether overpayments are beneficial.

You can see the benefit of overpayments and when these will clear the loan, or target an end date for the loan and see the necessary overpayments required.

Compare the impact of distributing a profit all as salary against reducing this to a small salary plus dividends, along with the additional employer pension contribution that could be made.